How to set up the process for credit approval - Decisimo

Published on: 2024-08-10 18:37:05

Every new market entrant looks at how to build its credit approval process. With digitization and automation of credit lending, the process of every step is being scrutinized and optimized.

The general process of credit process has 8 steps:

- Application

- Verification

- Credit Check

- Minimal requirements evaluation

- Underwriting

- Approval/Denial/Counter-Proposal

- Documentation

- Funding

These steps may vary depending on the loan purpose and the financial product.

Application

During this step, a customer submits an application for a credit product. The application should include information about the customer such as their name, address, contact details, employer details, income, and more. Here the customer has to disclose information about their financial standing. The application form process collects information necessary for making decision.

Verification

The lender can start the verification process in order to check the customer’s details. This can include checking their credit history, verifying their identity, monitoring the customer’s past payment records, or anything else that’s necessary to assess the customer’s creditworthiness. The bank or lender can also pull additional customer information from third-party sources, such as criminal records, public records, and other financial information.

Credit Check

During this step, the lender will check the customer’s credit report to determine the customer’s creditworthiness. The credit report includes a variety of information such as payment history, credit utilization, debt burden, and more. The credit report will have to be evaluated to determine if the customer is a suitable candidate for the loan.

Minimal Requirements Evaluation

At this stage, the lender will evaluate whether the customer meets the minimal requirements for the loan. This includes such things as the customer’s income, employment status, and other criteria. The customer may also have to provide supporting documents such as tax returns, or pay slips. Minimal requirements are usually defined as KO rules.

Underwriting

Underwriting is when the lender reviews the customer’s application, verifies all their details, and assesses their creditworthiness. Based on the information gathered, the lender will decide whether the loan can be approved. During this process, the lender may use models or algorithms to determine the probability of default.

Approval/Denial/Counter-Proposal

After completing the underwriting process, the lender will decide whether to approve the loan, deny it, or offer a counter-proposal. Counter-proposal might include a lower amount, longer term, or a different interest rate.

Documentation

The lender will require the customer to sign off on the loan documents. This includes contracts, statements, and more. Documentation is important for potential debt recovery processes or for securitizing the loan.

Funding

After all the documentation has been signed, the lender will release the funds to the customer. In terms of consumer purchase credit or BNPL, the funds may be disbursed directly to a merchant.

How the approval process can be improved

The credit approval process can be improved over time by analyzing the data gathered from previous loans, and looking for any potential risk factors.

This is why it is important to have a well-structured process and have a system in place to monitor customers’ payments and creditworthiness over time.

It is also important to keep the process efficient and up-to-date in order to reduce time for approval and increase consumer satisfaction.

Which parts of credit process can be automated

All the parts of the credit approval process can be automated.

Application Process

The application step can be automated with the use of an online form that requires the customer to enter their details. Once data is collected, it is sent into automated process.

Verification Process

The verification step can also be automated by checking customer records, running credit checks, and verifying customer identities. These can range from face recognition to other checks using third party services.

Credit Check Process

The credit check process can be automated using AI and machine learning algorithms, which can assess the customer’s creditworthiness more efficiently and accurately than a human. The decision logic is then put into an inference engine, rule engine or decision engine.

Minimal Requirements Evaluation

The minimal requirements evaluation can be automated by setting up certain criteria that the customer must meet in order to be eligible for the loan. Those are usually straightforward credit business rules.

Underwriting Process

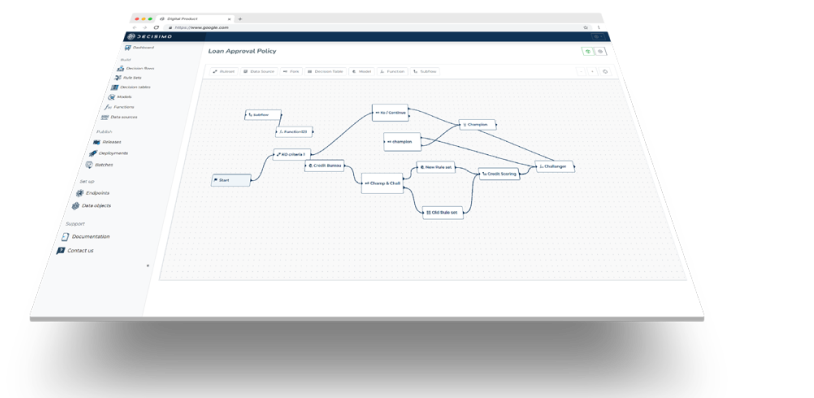

The underwriting process can also be automated by using algorithms that are specifically designed to assess credit risk. Those can be simple rules or machine learning models combined with other logical steps such as decision trees or decision tables.

Approval/Denial/Counter-Proposal Process

The approval/denial/counter-proposal process can also be automated. This could be done by setting up parameters such as the amount, duration, and interest rate of the loan within a decision engine.

Documentation Process

The documentation step can be automated by having the customer sign their loans electronically, or by using digital signature technology

Funding Process

The funding process can also be automated, by having the loan funds disbursed automatically once approved.

What can prevent automating the whole process

Apart from technological competency of a lender, the process can be prevented from being automated by local regulations or immaturity of digitalization of the country in which a lender operates.

The automation is dependent on the local regulations as in some countries, the application step which usually contains KYC (Know Your Customer) information will have to be manually approved.

Also, some countries do now allow electronic signatures for loan documents and require in-person contract signing.

What are the required technologies for automating credit approval process?

The required technologies for automating credit approval process include:

- Face recognition & comparison technology: To verify customer identity

- OCR (Optical Character Recognition): To convert documents into digital format

- AI/Machine Learning Algorithms: This technology is necessary for automating the credit check process, as it can assess the customer's creditworthiness more efficiently and accurately than a human.

- Decision Engines: A decision engine is a tool which uses decision logic to evaluate if an application should be accepted or rejected. It allows for automated decision-making based on predefined business rules.

- Data Gathering: This technology allows the lender to gather the data needed to assess an application and verify the customer's identity.

- Digital Signature Technology: Digital signature technology allows the customer to sign loan documents electronically. This is necessary for the automation of the documentation step.

- API Integration: This allows the lender to integrate with other systems and applications, allowing for more efficient and streamlined data gathering and processing.

- Automated Payment Technology: This technology allows for the automated disbursement of loan funds once the loan has been approved.