Deployment of Risk Management Decision Engines in Consumer Lending

Published on: 2024-08-18 22:51:40

Improving Risk Management Decision Engines in Consumer Lending

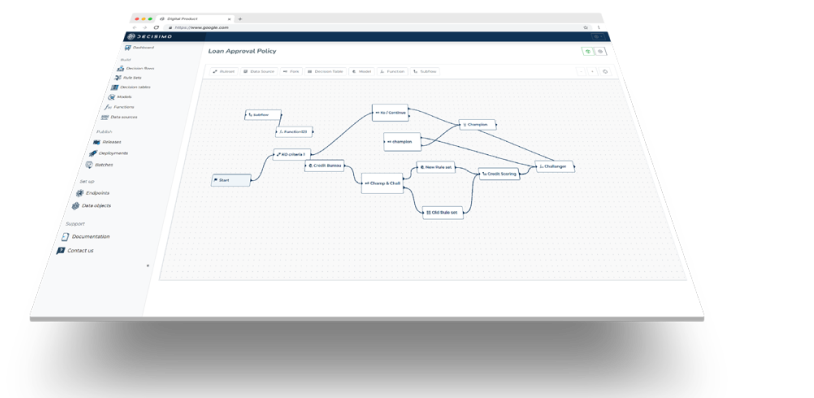

In consumer lending, a strong risk management system with an effective decision engine is key. This article covers practical ways to set up these engines for better risk management and adaptability in the lending sector.

Rule Prioritization

The decision engine uses a set of risk management rules in a clear order. The focus is on using internal rules first before moving to external data sources, which helps in saving costs.

Absolute risks, known as KO Criteria or Hard Rejects, target customers who are categorically unsuitable for the portfolio. Triggering such a rule leads to instant rejection, conserving resources. These rules may be sometimes called credit lending eligibility rules.

Flexible Rules

Adapting to new data is crucial in risk management. The system should allow for easy changes to rules based on new information. This means having the ability to turn rules on or off depending on their effectiveness and adjusting them as needed based on the latest data.

Keeping Detailed Records

It's important for the decision engine to keep detailed records of all actions. This includes tracking every rule applied to each customer and the outcomes. Keeping these records helps in refining future decisions and is useful for managing loans after they are issued.

Using Modern Modeling Methods

In consumer lending, especially for products with flexible limits and rates, using modern modeling methods is essential. These methods, including scorecards, help in assessing risks more accurately. They support both automatic decision-making and manual reviews, making the process more effective.

Conclusion

A decision engine in consumer lending is not just for managing risks. It's about building a system that can quickly adjust to new information and market changes. Integrating tried-and-true methods with newer technologies like machine learning helps in making better risk evaluations. A system that updates and refines decisions based on new data ensures an efficient, secure, and balanced lending process.

Key Points to Remember:

- Order of Rules: Start with internal rules before using external data to save costs.

- Rule Flexibility: Change rules as new data comes in.

- Detailed Record-Keeping: Track every decision and its result for future use.

- Modern Modeling: Use current models for more accurate risk assessment.

- System Adaptability: Make sure the system can quickly adapt to new information and trends.