7 Savvy Steps to Get Rid of Manual Underwriting - Decisimo

Published on: 2024-08-10 18:37:05

Manual underwriting is an essential aspect of the credit approval process, especially when it comes to assessing applications from people with unique or complex financial circumstances.

However, it can be time-consuming and costly for both lenders and applicants.

Technological advancements and data analytics have made it possible to automate much of the credit approval process, reducing the need for manual underwriting. In this article, we will discuss the process of selecting a rule engine and implementing rules to streamline the credit approval process.

1. Identify and document existing rules in manual underwriting

The first step in automating the credit approval process is to identify and document the existing rules used in manual underwriting. These may include guidelines for evaluating credit history, income, debt levels, and other factors that contribute to creditworthiness. Thorough documentation ensures the rules are well understood and can be easily translated into an automated system.

2. Categorize and prioritize rules

Once the rules have been documented, categorize them based on their importance and relevance to the credit approval process. This will help prioritize which rules should be incorporated into the rule engine first and which may need to be modified or replaced during the automation process.

3. Select a suitable rule engine

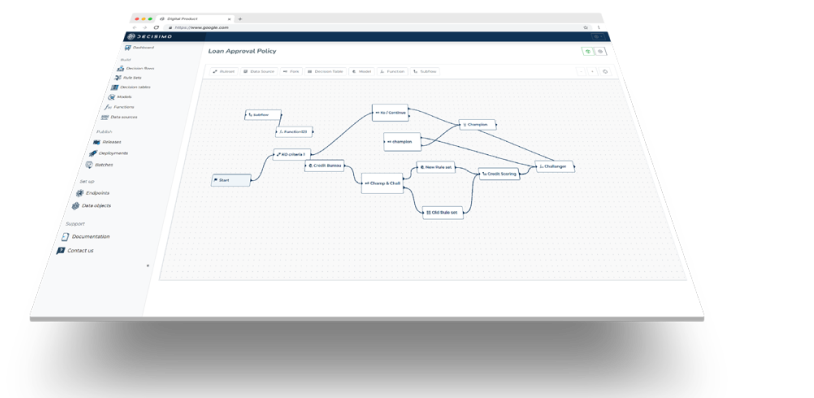

With the rules documented and prioritized, it's time to select a suitable rule engine that can process and evaluate the various criteria used in manual underwriting. When choosing a rule engine, consider factors such as ease of integration, scalability, adaptability to changing regulations and industry standards, and the ability to handle complex rules and conditions.

4. Implement rules into the selected rule engine

After selecting the appropriate rule engine, begin implementing the documented rules into the system. This may involve translating the rules into a format compatible with the rule engine, as well as testing and validating the accuracy and effectiveness of the implemented rules.

5. Integrate the rule engine into the credit approval process

With the rules implemented in the rule engine, integrate it into the credit approval process. This integration should include the collection and analysis of relevant data, such as credit scores, income statements, bank statements, employment history, and other financial data. The rule engine will then evaluate the applicant's creditworthiness based on the established rules.

6. Ensure data quality and accuracy

To maintain the accuracy of automated credit decisions, it's crucial to ensure the quality and accuracy of the data collected and analyzed. This can be achieved through various means, such as data cleansing and validation tools, as well as regular audits to identify and correct errors or discrepancies.

7. Continuously monitor and update rules

Finally, to ensure that the rules used in the rule engine remain relevant and effective over time, lenders must continuously monitor and update them. This may involve incorporating new data sources, adjusting the rule engine's algorithms, and reevaluating the factors used to assess creditworthiness.

In conclusion, by selecting a suitable rule engine and implementing existing rules from manual underwriting, lenders can streamline the credit approval process while maintaining the quality and accuracy of credit decisions. This approach allows for a seamless transition to an automated system, benefiting both lenders and applicants.