Evaluating the ROI of Transitioning to Decision Engines for Risk Management - Decisimo - Decision Intelligence Services

Published on: 2024-08-10 18:36:09

Introduction

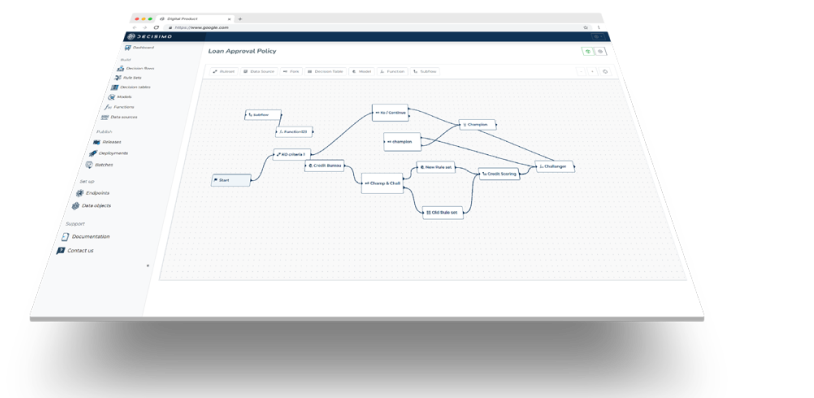

Decision engines offer lending companies the ability to streamline loan approval processes, reduce development costs, and enhance risk management. This article evaluates the ROI of transitioning from a hard-coded risk management system to a decision engine, using an imaginary Latin America-based lending company as a case study.

The Current State of Affairs

- Internal software development cost per man-day: $800

- Additional costs: QA, DevOps, Business Analysts

- Process: Risk analysts write business requirements, undergo reviews, then proceed to software development

Challenges Faced

- Capacity Constraints

Competing priorities often result in a shortage of development resources. - Hidden Costs

Costs are sometimes difficult to quantify, particularly in risk management where problems may have cascading effects. - Time-to-Market

Long development cycles, testing, and UAT increase the time to deploy risk management updates. - Explainability

Auditing rules require risk analysts to read the actual code, complicating the audit process.

Cost-Benefit Analysis: Transitioning to Decisimo

- Direct Cost Savings

Reduction in development man-days means direct cost savings. Even a 25% reduction in development time translates to savings given the $800/day rate. - Efficiency in Risk Management

Quickly update risk algorithms, reducing the risk of fraud and its cascading effects. - Reduced Time-to-Market

Quicker approval and deployment cycles mean faster response to market needs. - Enhanced Explainability

Decision engines like Decisimo offer rule management features that enhance explainability without requiring coding expertise.

ROI and Cost-Benefit Analysis

Cost Implications: Current System

Let's consider the cost involved in making two changes to risk algorithms per month:

- Risk Analyst and Business Analyst: $1,200

- Software Development: $4,000

- QA Testing: $1,600

- DevOps Deployment: $800

Total Monthly Cost: $7,600

Annual Cost: $91,200

Cost Implications: Decisimo

By transitioning to Decisimo:

- Monthly Subscription Fee: $1,500

- Retained Internal Costs: $600

- Amortized Integration Cost: $133.33

Total Monthly Cost: $2,233.33

Annual Cost: $26,800

ROI Breakdown

The ROI is a critical indicator of the viability of the transition:

- Monthly Savings: $5,366.67

- Annual Savings: $64,400

- ROI: 240%

Accounting for Internal Costs

Consider internal costs for integration. Two man-days estimated for IT development at $800/day totaling $1,600. Amortize this over 12 months.

Conclusion

Transitioning to a decision engine like Decisimo can resolve multiple pain points for lending companies. It can lead to significant cost savings, enhanced risk management, quicker time-to-market, and better auditability. For companies facing resource constraints and complex, hard-coded rule systems, the financial and operational advantages make a compelling case for change.