The benefits of using a SaaS decision engine over a spreadsheet - Decisimo

Published on: 2024-08-10 18:36:09

The Need for Advanced Decision-Making Tools

In today's business environment, companies must make important decisions that can impact their operations and bottom line.

The traditional approach to decision-making often involved using spreadsheets, but as the amount of data continues to grow, a more advanced tool is needed.

This is where decision engines or rule engines come in, offering a range of benefits over traditional spreadsheets.

What is a Decision Engine?

A decision engine, also known as a rule engine, is a software tool that allows businesses to automate decision-making processes based on pre-defined rules.

These rules can be complex and involve multiple data sources and variables, which can be difficult to manage using traditional spreadsheets.

Decision engines offer a range of features that make it easy for businesses to implement complex decision-making processes.

Automation of Decision-Making Processes

One of the primary benefits of using a decision engine over a spreadsheet is the ability to automate decision-making processes.

Decision engines allow businesses to apply pre-defined rules to data, which can save time and reduce the need for manual intervention.

This is particularly useful for businesses that need to make decisions in real-time or process large amounts of data on a regular basis.

Use of Machine Learning Models for More Informed Decisions

Decision engines also offer the ability to use machine learning models to analyze data and make more informed decisions.

This can be particularly useful for businesses that deal with large volumes of data and need to make decisions quickly.

Machine learning models can help to identify patterns in data, enabling businesses to make more accurate decisions.

Real-Time Rule Updating and Adaptability

Another benefit of using a decision engine is the ability to make changes to decision-making processes in real-time.

Decision engines enable businesses to update their rules and logic on-the-fly, which is not possible using traditional spreadsheets.

This means businesses can quickly adapt to changes in the market or industry without having to spend time manually updating their spreadsheets.

Advanced Features: Rule Sets, Decision Tables, and Decision Flows

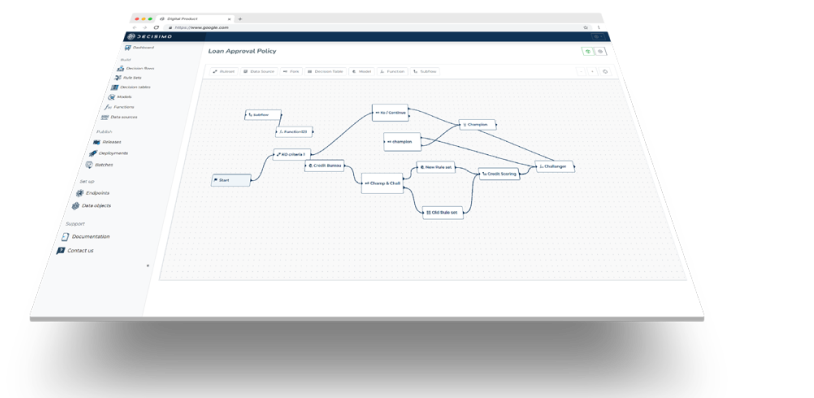

Decision engines, like Decisimo, also offer advanced features such as rule sets, decision tables, and decision flows, which allow businesses to create and implement sophisticated decision-making processes.

Rule sets enable businesses to define and update their business logic easily, while decision tables allow for the evaluation of multiple independent and dependent variables, making it possible to create complex decision-making processes.

Decision flows enable businesses to visually map out the flow of their decision-making process, making it easier to understand and modify.

Data Source Connections and Batch Processing Capabilities

Decision engines also offer data source connections and batch processing capabilities, making it possible to access and process large amounts of data in real-time.

This is particularly useful for businesses that need to process large volumes of data on a regular basis, such as financial institutions, credit bureaus, and healthcare providers.

Spreadsheet Limitations for Lending Companies

In addition to the challenges mentioned in the earlier sections, there are other reasons why using a spreadsheet as a decision-making tool can be problematic, especially for lending companies.

Many lending companies have credit policies in spreadsheets that contain a set of rules and logic that calculate a final credit score based on manually inputted values.

While this method may have worked in the past, as the volume of data and number of variables increases, the risk of error also increases.

Overcoming Spreadsheet Limitations with a Decision Engine

Spreadsheets can be difficult to keep up-to-date and mistake-proof when there are multiple users involved. Credit officers need to manually update and maintain the spreadsheet, which can lead to versioning issues and mistakes.

Furthermore, spreadsheets offer limited version control, which can make it difficult to track changes and who made them. This can result in discrepancies and inconsistencies in the decision-making process.

Using a decision engine, like Decisimo, can help lending companies overcome these challenges. Decision engines provide a centralized platform for rule management, making it easier to update, maintain, and control the versioning of rules.

Decision engines also offer more robust version control and audit capabilities, making it possible to track changes and who made them. This makes the decision-making process more transparent and error-proof.

Moreover, decision engines offer the ability to test and refine rules before they are deployed in a production environment.

This means that credit officers can see the impact of rule changes before they are implemented, reducing the risk of errors and mistakes.

The Benefits of Using a Decision Engine

As businesses continue to generate more data and need to make more informed decisions, the benefits of using a decision engine will become increasingly clear.

Decision engines offer the ability to automate decision-making processes, create and implement sophisticated decision-making processes, update rules and logic in real-time, and use machine learning models to make more informed decisions.

They also offer data source connections and batch processing capabilities, making it possible to access and process large amounts of data in real-time.

If you're considering using a decision engine, like Decisimo, to help streamline and automate your decision-making processes, it's important to do your research and choose a platform that meets your specific needs.

With the right decision engine in place, you can save time, reduce the risk of errors, and make more informed and accurate decisions that can have a positive impact on your business.