Advanced Fraud Rule Engines: Complex Policies and Third-Party Data

Published on: 2024-08-10 18:29:56

In the continually evolving field of ecommerce and online payments, fighting fraud is not just about detecting malicious activities but also about proactively preventing them. The complexity of modern fraud patterns requires an advanced approach to data enrichment and a comprehensive antifraud policy that integrates multiple data sources and rule sets. A modern fraud rule engine emerges as the backbone of such a strategic approach.

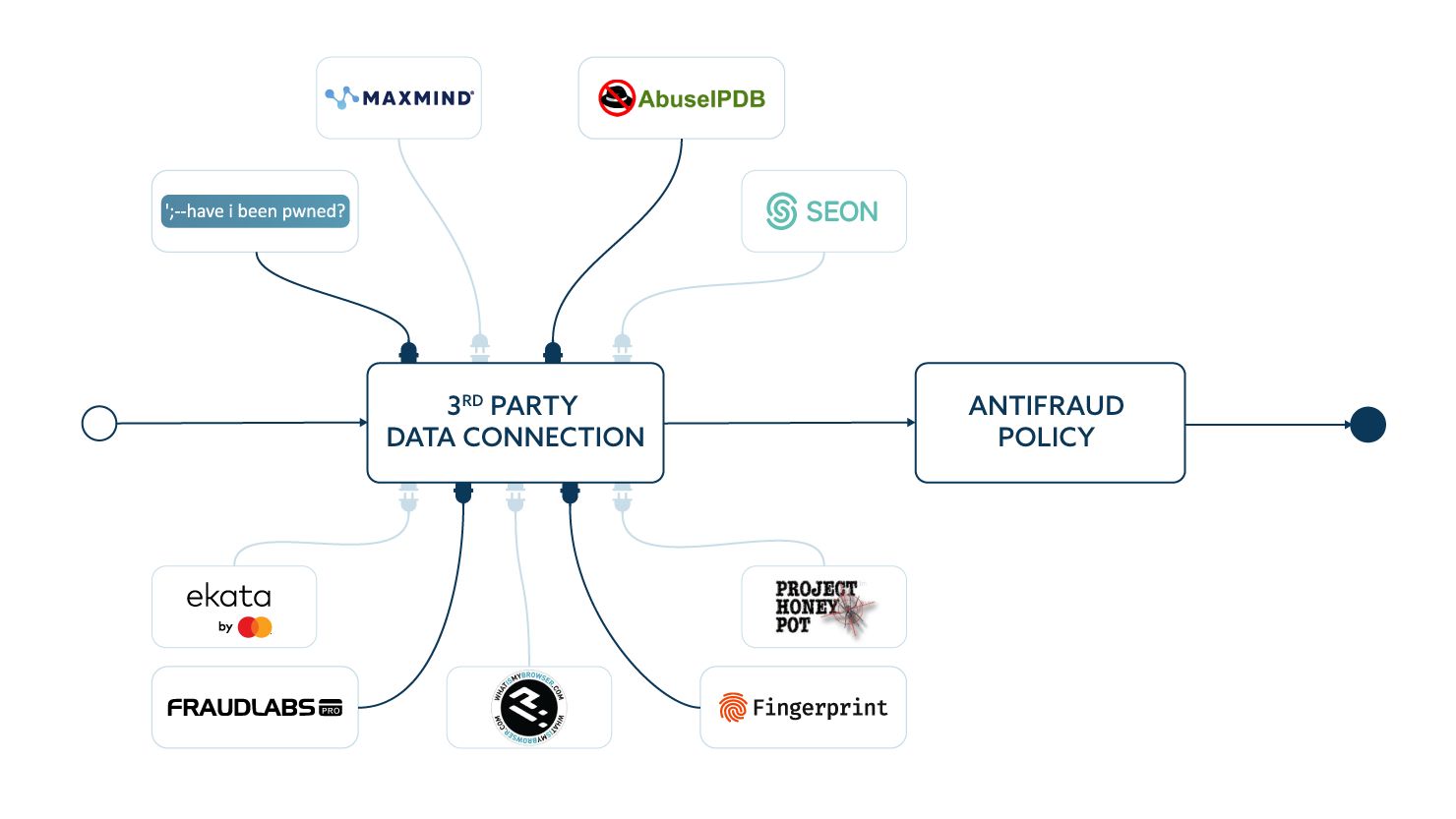

Multiple Data Sources for Maximum Fraud Detection

An efficient fraud rule engine needs to call multiple data sources simultaneously. This multipronged approach not only bolsters the fraud detection capability but also ensures an unhindered customer experience. Sequential data calls can lead to delays and subsequently compromise customer experience, which makes simultaneous data sourcing an absolute necessity.

These data sources can be:

- IP-focused: Providing data enrichment focused on IP addresses.

- Email-focused: Primarily concentrating on email addresses for data enrichment.

- Verification Processes: Including the physical address verification.

- Transaction Risk Evaluation: This involves both enrichment and scoring of the entire transaction to gauge risk levels.

Behavioral Information and Social Network Presence

In addition to these conventional data sources, an efficient fraud rule engine also accounts for behavioral information from browser/device fingerprinting and social network presence. This adds another layer to the existing security measures, making the antifraud policies even more effective.

Scoring and Machine Learning

Once the data is aggregated, scoring becomes the next step. Many sophisticated companies employ machine learning models for this purpose. Logistic regression, random forest, gradient boosting are some of the commonly used methodologies. Despite such advanced scoring techniques, the role of rules remains pivotal, mainly to establish knockout (KO) criteria.

Segmentation and Decision Making

The final piece of the antifraud policy puzzle lies in segmentation and decision making. The usual decisions made by an antifraud system are APPROVE, REJECT, and REVIEW, with the latter indicating a manual review requirement.

However, recent trends show a rise in 'ESCALATE' decisions. These involve imposing additional verification or information request processes on the user, thereby adding another layer of security without outright rejecting the transaction.

In conclusion, to combat the increasing complexity of fraud, a modern fraud rule engine needs to integrate multiple data sources, incorporate behavioral information, apply sophisticated scoring methodologies, and implement precise segmentation and decision-making processes. By doing so, we not only ensure a secure transaction environment but also maintain a smooth user experience, striking a delicate balance between fraud prevention and customer satisfaction.